When you partner with a payment processor, you’ll receive a monthly statement that breaks down all the credit card processing fees that you’re paying to use their services in your restaurant.

From processing fees to flat fees to situational fees, every last penny will be arranged on the page – often in complex ways, including multi-page charts, unclear abbreviations, and dizzying calculations.

If you find yourself confused about what to do with this monthly statement, you’re not alone. Merchants of all stripes – including restaurateurs – struggle to keep track of the slew of credit card processing fees and other bewildering information in their statements.

Luckily, we’re here to help. In this article, we’ll help you get a handle on what you’re paying (and why) by covering:

- The fundamentals of small business credit card processing fees

- How to read a credit card processing statement

- 3 things to look for when analyzing your monthly statement

Everything you need to know about credit card processing

Credit Card Processing Fees Explained

Before you dive headlong into your statement, it’s important to double-check that you understand the fundamentals of small business credit card processing fees.

Everything you need to know is in The Ultimate Guide to Payment Processing for Restaurants, but here’s a quick refresher..

Payment processing companies charge three types of fees: flat, situational, and processing.

Flat fees include online reporting, network, payment gateway, annual, and statement fees. Some of these debit and credit card rates and fees are negotiable and some aren’t – it pays to know the difference.

Situational fees are charged as they come up for things like cancellations, chargebacks (customer refunds), international cards, and monthly minimums. You can negotiate rates for some of these fees as well.

Debit and credit card processing fees will be the lion’s share of costs found on your monthly statement. Every time a customer uses their card to pay, that transaction comes with percentage-based fees that go to the issuing bank, the brand card network (e.g. Visa or Mastercard), and the payment processor, which routes the money from one entity to the other.

Your payment processor will filter and summarize these rates and fees, and you’ll see them as part of the credit card processing fees on your monthly statement.

Still in the market for an integrated payments processor? Here’s a pro tip: Be sure to choose a reputable organization with free 24/7/365 support, so you have the customer service you need to get the most from your monthly statements.

How to Read a Credit Card Processing Statement

Now that you have a basic grasp on what kind of fees you’ll find on your payment processing statement, now it’s time to learn how to read a credit card processing statement and what to look for.

The best way to read your monthly credit card processing statement is to zero in on the three key elements outlined below:

1. Find Your Effective Rate

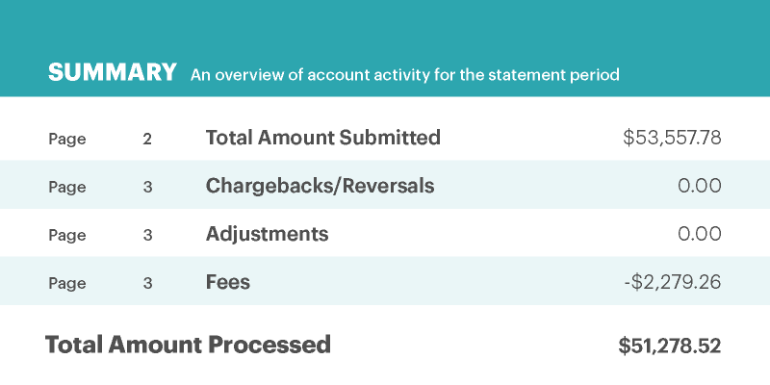

The format of monthly statements will vary by company and pricing model, but most lead with the big numbers, i.e. your effective rate. This is the total dollar amount of your monthly credit card transactions minus the total dollar amount of fees. In other words, the effective rate is what you paid for restaurant merchant services.

A simple way to make sense of those numbers and understand how much credit card processing truly costs is to divide the total amount in fees by the total amount in transactions, and multiply by 100. This will give you the percentage of fees you’re paying per transaction.

For example:

($2,279.26 / $53,557.78) x 100 = 4.26% in credit card fees this month.

Do this quick calculation every month to see if your credit card fees are increasing, decreasing, or staying about the same. If you see a variation, you may choose to dig deeper into your credit card processing statement to understand where those extra fees are coming from.

It’s easy to miss a letter or email from your payment processor sharing news about increased rates, changing fees, or new charges they plan to levy. Finding your effective rate each month will help you know when to play detective on your monthly statement. If your effective rate varies every statement or shoots up or down one month, you’ll want to find the root cause and get in touch with your payment processor to make sure there haven’t been any big changes you should know about.

2. Review Your Credit Card Mix

One part of the processing fees breakdown is your credit card mix, which refers to cost associated with the type of card and method of payment.

Type of Card

In a restaurant, it’s common for customers to use a wide variety of credit cards. However, you should keep in mind that credit cards that offer their cardholders lots of rewards cost you, the merchant, more per transaction than debit cards or basic credit cards with no perks.

For example, a student credit card with a low limit will have a lower processing fee than a platinum card with travel perks. So if you run a restaurant full of diners with fancy credit cards, it will cost you more in processing fees than a dining room of students who pay with debit cards.

However, diners who have elite credit cards are also more likely to dine out – and rack up larger restaurant bills when they do – so the processing fees may be something worth absorbing.

It’s also important to note that international cards will also cost you.

When diners from out of the country use their credit cards in your restaurant, your payment processor will charge an additional processing fee to route their transactions. This will show up on your statement as a higher processing fee – and also as a per-transaction situational fee. This is especially important to keep in mind if your restaurant caters to a lot of tourists or other international visitors.

Payment Method

It’s not just the type of credit cards you accept that will impact your fees, but also how they are processed.

As a restaurant owner, the more payment processing options you offer, the better. This may include:

- Manual: Server or cashier manually enters the credit card number.

- Swipe: Customer swipes their card in the terminal and signs the receipt.

- Dip and sign: Customer inserts their card into the terminal and signs the receipt.

- Chip and PIN: Customer inserts their EMV chip card into the terminal and enters a PIN to finish the sale.

- Tap: Customer taps their EMV card on the terminal – no signing or PIN required.

- Digital Payments (Apple Pay, Google Pay, Samsung Pay): Customer uses their device, placing it over the terminal to authorize mobile payments – no physical contact or signature required.

When considering how to accept credit card payments in your restaurant, freedom and flexibility for your customers should be a top priority. However, it’s important to keep in mind that not all payment processing methods are created equal.

Methods of payment that are less secure (e.g. swipe) will cost more per transaction than digital payments because they’re more open to fraud. And if you take orders over the phone (known as a card-not-present transaction), your payment processor will charge even more because this method carries the highest risk of fraud.

Remember that part of the payment processor’s service is to take on the responsibility for fraud. They assume the risk and help to mitigate fraud, and your credit card processing fees are based, in part, on the level of risk.

Payment Processing Pricing Models

Even if your effective rate is relatively similar each month, it’s helpful to take a quick look at the credit card mix on your statement to make sure the pricing model you’ve agreed on is still the best fit for your business.

And if you are reevaluating the pricing model you’ve agreed on, it’s important to know what your options are.

Cost Plus Pricing

Most restaurants prefer the Cost Plus pricing model (aka Interchange Plus or Interchange Pass-Through). This model makes the merchant responsible for the non-negotiable interchange fee and the processor markup, which consists of a fixed percentage of the total check, the card brand fee, and a per-transaction flat fee. All fees are transparent, so you can see a breakdown of all processing fees:

Interchange fee + % of total check + card brand fee + transaction fee = total processing fee

Example:

1.54% + 0.10% + 0.10% + $0.25 = 1.74% + $0.25 total processing fees

Under the Cost Plus pricing model, higher transaction volumes and a varied card mix make up for the additional fees you may have to pay when diners use higher-end credit cards and various payment types.

While paying a custom rate per transaction means that your payment processing fees may be a bit less predictable, the tradeoff is that you generally get the most equitable rate.

Fixed Rate Pricing

Unlike the Cost Plus pricing model, other pricing models don’t break down the credit card mix in the same way on monthly statements. For example, a Fixed Rate or Flat Fee pricing model charges a percentage-based fee plus a dollar amount for each transaction.

% of total check + transaction fee = total processing fee

Example:

2.75% + $0.25 = 2.75% + $0.25 total processing fees

The benefit of the Fixed Rate pricing model is that merchants know exactly what to expect when it comes to transaction fees with this pricing model.

However, one of the drawbacks is that payment processors often set higher fees to try to balance out the variations of the credit card mix and payment types. That means you’re paying the same higher rate for basic credit card and debit card transactions as you are for elite cards. In other words, you could end up paying a lot more in credit card processing fees than you need to.

Another drawback to a Fixed Rate pricing model is that your payment processor reserves the right to increase the price of the flat fee at any time during the contract. Though payment processors generally have to provide advanced notice of any price increases, merchants often don’t have a say in negotiating these increases, meaning you may have no choice but to pay higher fees each month.

With this type of pricing model, you may also need to do additional digging to see the credit card mix in your restaurant because it may not be explicitly tallied for you on your credit card processing statement the way a Cost Plus pricing model does.

Everything you need to know about credit card processing

No matter what type of pricing model you choose, understanding your credit card mix is a smart business decision.

Not only will you ensure you’re not overpaying in credit card processing fees, but you’ll gain important insight into your restaurant’s clientele. This will help you tailor your menu, service, specials, and more to provide the best service to your customers.

For example:

- If you get a lot of international credit cards when conventions are in town, you may choose to adjust your advertising or partner with companies or hotels that host these international business events to make your restaurant a destination for every traveller.

- If you note that most of your Friday night payments are made with debit, student and/or basic credit cards, you’ll have a good indication that price is a factor for this segment of your clientele. You can embrace these customers by offering menu specials tailored to them on Fridays, but also other nights of the week too.

- By contrast, if Saturday nights are mainly populated by guests with higher-end rewards cards, you can assume they’re more willing to splurge on pricier entrees and wine/cocktails. You could adjust your menu on those nights to cater to these diners who are open to spending more to get more.

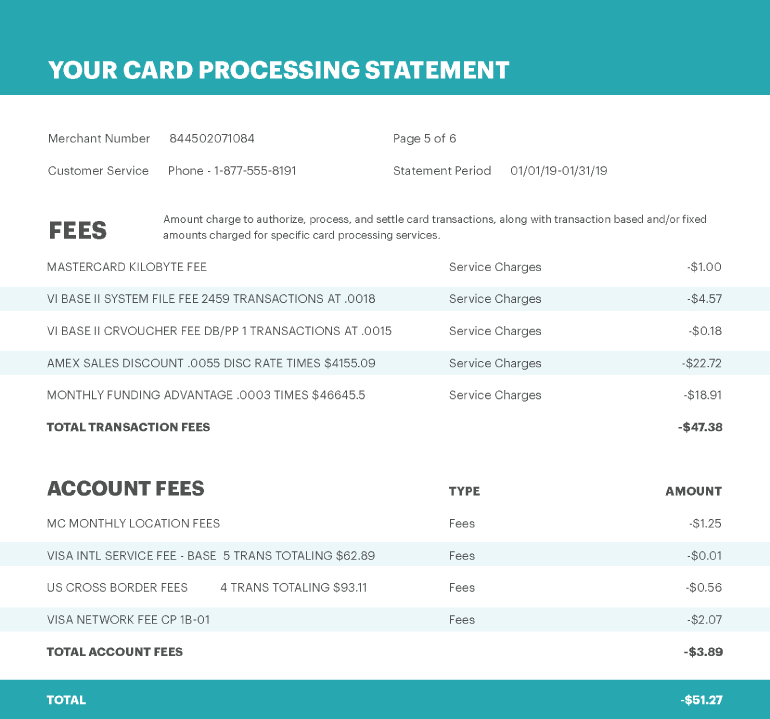

3. Review Flat and Situational Fees

The final elements to pay attention to on your monthly credit card processing statement are your flat and situational fees.

Remember, flat fees include online reporting, network, payment gateway, annual, and statement fees. Situational fees are charged as they come up for things like cancellations, chargebacks, international cards, and monthly minimums. In both cases, there’s room for some negotiation.

Take a magnifying glass to the flat and situational fee sections of your monthly statement. Make sure you understand each fee – and don’t be afraid to call your payment processor to discuss the negotiable ones.

This is the section where confusing abbreviations and obscure terms are most likely to come into play – don’t be intimidated!

Your rate negotiations with your payment processor can include asking questions about these fees. Not only will you learn important terms that will help you read future statements, but you’ll likely open a line of communication that could come in handy if you need to dispute any false charges that don’t reflect your account activity. These charges can be removed at the request of a merchant – if you’re paying attention.

While you’re poring over your monthly statement, look for notices of rate increases. Keep an eye out so you know exactly what to expect, and be sure to ask if you’re not sure if the new rates are negotiable.

Interchange Rates

One rate to pay attention to is the interchange rate. Interchange rates are set by individual credit card companies (e.g. Visa or Mastercard), not payment processors, and are not negotiable. These rates are typically adjusted twice per year.

These rates are publicly posted on credit card brand websites. Remember, the interchange rate for each transaction depends on the type of card (student vs. elite travel) and the type of payment (swipe vs. PIN).

As a merchant, you are entitled to 90 days’ notice by your payment processor when the interchange rate – or any fee – changes. When you receive a notice of a rate increase, you are allowed to cancel your contract within that 90-day period, without the threat of a penalty.

If you’re still having trouble reading your statement, consider calling your payment processor and asking them to walk you through it, line by line.

Make notes about every part of it and ask them to review your pricing model with you to be sure it’s still the right fit for your business. Sometimes, processors can give you tailored rates or even blended pricing models that best suit your venue.

It may seem like a lot of work to try to decode all the credit card processing fees on your monthly statement. But once you’ve done it a few times, you may find some insightful information that’ll help your business – and you’ll be able to spot red flags when you see them.

Ready for a complete payment processing solution?

If you’re located in the U.S., learn more about TouchBistro Payments powered by Chase.

Outside the U.S.? Learn more about TouchBistro’s best-in-class payment processing partners.

Learn how to save money on payment processing fees

Free Resources for Restaurant Owners